- Gold $0.00 $0.00

- Silver $0.00 $0.00

- Platinum $0.00 $0.00

- Palladium $0.00 $0.00

Live Gold Price Today | Gold Spot Price Chart

Live Market Prices

| Metal | Bid | Ask | Change |

|---|---|---|---|

| Gold | N/A | N/A |

N/A

|

| Silver | N/A | N/A |

N/A

|

| Platinum | N/A | N/A |

N/A

|

| Palladium | N/A | N/A |

N/A

|

Live Gold Price Chart

Precious metals prices fluctuate by the minute, and our Live Market Prices chart is updated every ten seconds to give you a view of your investments’ real-time market status!

The Price of Gold Today

This chart shows side-by-side “bidding” and “asking” prices of gold, silver, platinum and palladium, as well as dollar change for each metal. If you’re getting poised to buy or sell a position any minute, our real-time reporting is a great way to pick exactly the right moment to pull the trigger.

Gold Spot Price by the Ounce, Gram & Kilo

The gold price chart shows current real-time prices for gold, silver, platinum, and palladium. These charts can be used to show gold prices for the hour, day, month, quarter, year-to-date, and 12-month period. Our slider tool allows you to select a custom range of dates for the pricing of gold and other precious metals. Simply slide the ends of the scroll bar to the desired date or time range to obtain the gold price for that specific time period.

For the latest price of silver, platinum, or palladium click on the desired precious metal in the menu directly above the interactive charts. Get a free investment guide to better understand the gold price chart and how precious metals fit within your investment portfolio or contact an investment representative at (800) 775-3504 for a FREE consultation.

Gold Price Daily Gauge

Whether you’re interested in knowing if a certain metal performed better in the morning or evening, or simply curious about hour-over-hour fluctuations, this is a great tool. After clicking into the chart, you’ll have the option to pick a metal and zoom in on its daily or even hourly performance. Tailor the view to show a metal’s price in hour-long time blocks or from a full-day perspective. Hover over the results to see hour-by-hour changes or adjust the sliding scale at the bottom to assess performance during different periods of the day.

Gold Price Monthly Gauge

Want to take a look at your metals’ performance over the last month? Six months? Year? Five years? The United States Gold Bureau’s monthly price gauge is the perfect place to gain some real longer-term insights into price performance of gold, silver, platinum or palladium. Functioning in much the same way as our Daily Price Gauge, our monthly charting tool allows you to view your investments through a per-month lens. After adjusting the sliding scale to set your desired time frame, hover over each peak and valley to see actual to-the-penny price changes.

Get Our Free

Investor's Guide

Buying and Investing in Gold

Gold is a precious metal, is indestructible and is circulated in limited supply. These features made it the ideal medium of exchange for value many millennia ago when the barter system started showing trouble in terms of longevity of commodities exchanged and disagreements over respective values. Today, individuals buy gold as both a short and long term investment. It is easy to see why - gold is one of the most stable (hence safe) investments one can make, and it is also easy to sell and buy gold, as it is an internationally recognized valuable metal.

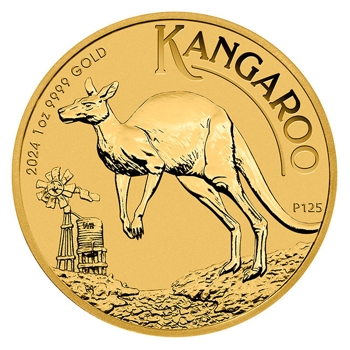

There are two options available for those who want to buy gold as an investment. The first is to buy gold bullion. These are gold bars or standard gold coins, which can be traded at the spot value for gold. Although this value steadily increases over time, short term dips and peaks are seen frequently and this kind of gold investment is hence exposed to some risk - in terms of changing equilibrium prices based on supply and demand variations for gold worldwide.

Buying gold bullion is one of the best 'safe' investment decisions one can make, especially if cash is inadvisable to hold over the short run in large amounts.

The second option is to buy gold in the form of rare coins, also called certified gold. Even though the price of gold bullion on the international gold market sees some fluctuation, the price of rare gold coins stays stable - in fact it only increases with time. This is because of the 'rarity' element in this gold - it was crafted centuries, or decades ago as might be the case, the craftsman who created it is no longer alive and so the number of these coins made by the craftsman in question must be limited - keeping supply strictly limited.

With such a limited supply (and even assuming a stagnant demand), the price of this gold is much higher than regular bullion gold traded in international markets.

The difference in prices when one goes out to buy gold in bullion form versus the rare coin form is quite substantial - gold in the rare coin form costs up to four times more than gold bullion. This price difference however, could be manifold, depending on the 'make' of the rare gold coin, its age, history and origin. Such gold is treated as a collectors' item and its price acts much like the price of rare art and other collectors' items. Needless to say, the price of authentic rare gold coins is inelastic to international gold market price fluctuations.

The United States Gold Bureau is a private dealer and distributor of both gold bullion and rare coins. It sells all kinds of precious metals and specializes in certified pre-1933 and modern gold and silver. The United States Gold Bureau's customers consist of collectors, dealers, accumulators, banks, brokerage houses, investors and speculators. This gold dealer can fulfill needs of all those wanting to buy gold as an investment - in amounts large and small.

Investing in Gold Bullion

Gold bullion in both coin and bar form is internationally recognized as a valuable commodity that can easily be turned to cash - it is the second most 'liquid' valuable commodity after cash. It is exchangeable at international gold spot prices worldwide, making it quite a versatile asset to hold. It is preferable to buy gold bullion if one fears too much fluctuation in foreign exchange rates, as international gold spot prices remain quite stable over short periods of time. Even if there is fluctuation in prices, it is much insulated as compared to the extent and frequency of volatility that even the most stable currencies experience.

Historical Performance of Gold Eagle Proof 70 Sets:

The chart on the left (top on mobile) is a case study of a snapshot in time from 2010 to 2016. Over this time period, the price of gold started to rise, causing the value of both bullion and Investment Grade Coins to increase. When the price of commodity gold started to cool, the market for Investment Grade Coins improved even more, driving up the price of Gold American Eagle Proof 70 coin sets. The chart on the right (bottom on mobile) shows the price performance of the most recent Gold Eagle Sets, which are not included in the chart on the left (top on mobile). This data suggests a strong market for Investment Grade Coins and could signal the beginning of another boom cycle.

Buying Gold from United States Gold Bureau

The United States Gold Bureau is a respected and trustworthy source to buy gold bullion as well as bullion in other precious metals (these include platinum and silver). Apart from bullion, rare coins are available from both the pre-1933 period as well as more modern limited mint editions.

One can buy gold bullion (or any other metal) if a short term safe investment opportunity is preferred. This precious metal bullion can then be sold at international spot prices for these metals in any precious market in the world, for the respective currencies in these markets.

Rare gold, platinum and silver coins from the pre-1933 era as well as modern mints can also be bought from the United States Gold Bureau. If one does not wish to buy gold bullion (or wants to supplement it in order to diversify), and wishes to hold the precious metal for a longer time frame, these rare coins are the perfect option. As rare coins are in limited supply, their price steadily increases over time. This happens because even though more gold is being mined every day, the number of these coins (minted by a goldsmith or the United States government in the past) stays the same. With time, the value of these rare coins increases and one can sell these at a handsome profit - usually if held for a long period, say for example a decade.

A major benefit for those who buy rare coins in precious metals (rather than buy gold bullion) is that the prices of these do not move along the spot price for regular gold (or other precious metal) bullion.

These coins are deemed 'rare', so they are in finite supply and are considered collectors' items. Hence, much like the prices of rare works of art, furniture and jewelry, rare coins also enjoy premium prices. Generally, the older and rarer, the more expensive, and the more immune to international gold (and other precious metal) spot prices.

The United States Gold Bureau is based in Austin, Texas. It has invested in a technologically state-of-the-art facility that enables it to process each order / transaction with the utmost care (considering the high value product they deal in). The United States Gold Bureau is an authorized precious metals dealer / distributor through both the PCGS and the NGC. Their investment education initiative regularly publishes a precious metal investment newsletter for customers and others who are signed up to receive this, keeping these individuals up to date with the precious metals investment scenario, trends in spot prices, and new mints as these are made available at the United States Gold Bureau.

Watch this short video to learn more about the U.S. Gold Bureau and our goal to help our clients understand the importance of diversifying within precious metals.

Our Commitment to You:

We will always be honest and upfront with you, we will treat you with respect, and we will complete your order exactly as we have presented it to you – each time, every time.

It's important that you know that much of our business comes from referrals from satisfied clients and we rely greatly on these referrals to keep our company going. For this reason, superior customer service is not just a commitment, it's a necessity. The ultimate compliment you can provide is a referral to a friend or family member, and we consider it a privilege to receive your endorsement.