- Gold $0.00 $0.00

- Silver $0.00 $0.00

- Platinum $0.00 $0.00

- Palladium $0.00 $0.00

Bullion vs Investment Grade

Diversification is Key

Investors have long understood the concept of diversification. In fact, it's the #1 reason people give for accruing precious metals in the first place. But most investors don't realize that it's not enough to just diversify INTO precious metals. To be truly diversified, you must also diversify WITHIN precious metals, by combining allocations of both bullion and Investment Grade Coins.

Understanding Bullion

Bullion is refined gold, generally in the form of minted coins and various sizes of bars. The value is primarily based on weight, the same as other commodities like crude oil, pork bellies, natural gas and wheat. This market index price is called the "spot price."

Privately made bullion includes coinage that does not have a face value recognized by any countries government but can bear a likeness to official mint coinage.

Minted bullion coins are made by official government mints and are made in accordance with federally mandated guidelines. They do carry a face value that is recognized within that country as official coinage, although most often their pure metallic makeup would prohibit a person from spending in a grocery store because oftentimes that metal value far exceeds the face value.

Understanding Investment Grade

Investment grade gold coins are valued for their rarity, rather than their weight. In addition to pricing and market variation differences, the production process for bullion and proof coins differ, as well. Proof coin production is a highly specialized process, and as a result, is labor intensive and requires a high degree of precision and oversight. Un-struck polished coin blanks are fed by hand into a coin press, where the blank will undergo several rounds of striking. The highly sharp and detailed images seen on Proof coins, particularly those earning the highest quality scores, are a result of these multiple rounds of strikings each coin undergoes. The more in-depth proof production process also results in coins that have the characteristically high-sheen background and overall pristine appearances.

Another way the value of your Investment Grade Proof coin can be solidified is by a quality score, or grade, as issued by an industry authority like the Numismatic Guaranty Corporation (NGC) or Professional Coin Grading Service (PCGS). While both bullion and Proof coins can receive grades that, in turn, indicate respective quality levels, grading for Proof coins helps bolster the value of Proof coins, whereas, with bullion, the value is derived from market factors and commodities prices.

NGC and PCGS rely on what is known as the Sheldon Scale when grading precious metal pieces. The Sheldon Scale, which was established in 1949 by William Herbert Sheldon and updated in the 1970s, denotes coin qualities via a rubric ranging from scores of one, which indicates poor quality, to 70, which indicates “perfect” quality. Only a small percentage of Proof coins ever receive the highest-level PF70 grade.

Proof coins obtained directly from the U.S. Mint do not come graded, and additional steps must be taken by the coin holder to get such a score. In step with our mission to provide clients with the highest quality products and most streamlined path to precious metals investing, the United States Gold Bureau is proud to eliminate the need for our clients to obtain grades on their own, a process that can be difficult and resource intensive. We offer a Proof coin inventory made up almost exclusively the highest PF70 pieces, pre-graded for you!

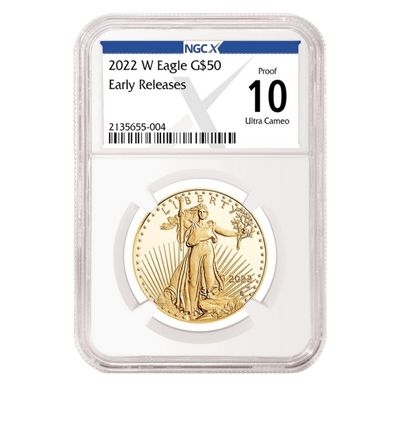

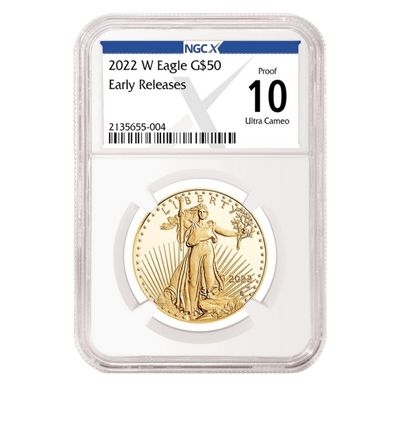

Understanding the NGCX Ten-Point Grading Scale

The newest advancement in the coin world came not from a world mint but from the world-leading NGC grading company. The ten-point grading scale has long been the standard for most collectibles, including comic books and sports cards. Now, with the introduction of NGCX, this ranking system will extend to coin investment, lessening the need to understand the more complex Sheldon scale of 1 to 70.

NGCX-certified modern coins, minted from 1982 to the present, will be eligible for the grading scale, coexisting with the industry-standard 70-point Sheldon grade. NGC states there is no difference in quality between a grade on the NGCX 10-point grading scale and a 70-point scale. On the NGCX scale, 10 is the supreme grade, equivalent to a 70 on the traditional Sheldon scale. For example, a coin graded NGCX Mint State or Proof 10 has no imperfections at 5x magnification, the same as a coin graded NGC Mint State or Proof 70. Likewise, an NGCX Mint State or Proof 9.9 is the same as a coin graded NGC Mint State or Proof 69 — each a fully struck coin with nearly imperceptible imperfections.

Investment coins with the ten-point scale will be available through the United States Gold Bureau, in January 2023.

Why Create a Diversified Precious Metals Portfolio?

This is the only way to create a portfolio that grows as the "spot price" rises, but is also protected from volatility and positioned for superior long-term growth. This simple strategy creates a metals portfolio that is diversified, more balanced and more secure.

Your specific mix of the two asset classes (bullion and Investment Grade Coins), should be determined by 3 main factors:

- Tolerance for risk

- Time Horizon/Liquidity Requirements

- Investment Philosophy

Portfolios that are heavily exposed to the bullion market are more aggressive and therefore more risky. They are generally recommended for short-term investors that are placing a bet on imminent market moves and are capable of stomaching a high-degree of risk, since prices can rise (or fall!) in a short period of time.

Portfolios that are more weighted in Investment Grade Coins are considered to be more secure and conservative, since the historical data indicated much less volatility than bullion, along with steady price appreciation. A minimum hold time of a least 5 years is recommended, to give the investment sufficient time to mature.

A balanced portfolio, with both bullion and Investment Grade Coins, is perfect of investors looking to limit their exposure to the ups and downs of the gold market price and shelter their investments from the geopolitical forces that are out of all of our control.